As we begin the second month of the year, I thought now would be a good time for a brief update on current market conditions and my projections for the rest of 2025. Now that the election is behind us and the new administration has taken office, I think a lot of the uncertainty that was so prevalent last year should start to diminish. I had several clients state last year that they did not want to make any changes to their flight department until the election was behind us. Now that it is, I think many feel the new administration should be overall more business friendly, regardless of how you might feel about the politics.

A few weeks ago, I had a chance to speak with some attorneys in our industry about the possibility about Bonus Depreciation coming back. The general consensus was that the new administration would push for it, but that we should not expect that push to come for several months. Getting a provision like that passed is a complicated process and several other agendas tend to come into the conversation. The administration probably only has one shot at getting it passed, and needs to garner as much support as possible before putting on the table. But if things play out right, we could see that come back later this year.

Turbine Aircraft Pre-Owned Market

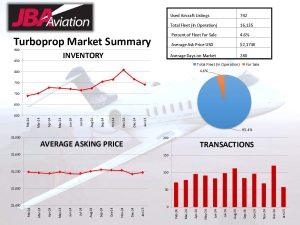

I have attached two graphs for your reference that should paint a picture of the current pre-owned marketplace.

Jet Market Snapshot

- There are currently 1,769 pre-owned jet aircraft listed for sale, representing just over 7% of the active fleet currently in operation.

- This represents a 12% increase in inventory over the same time last year.

- The average asking price of jet aircraft currently for sale sits at just over $6M.

- This represents a roughly $275K drop from the same time last year.

- The number of monthly transactions over the last 12 months has declined from last year, with December reporting about 25% fewer transactions in 2024 vs. 2023.

- Average days on the market have increased by almost 10% over the last year.

Turbo-Prop Market Snapshot

- There are currently 742 pre-owned turbo-prop aircraft listed for sale, representing 4.6% of the active fleet currently in operation.

- This represents a 13% increase in inventory over the same time last year.

- The average asking price of turbo-props has remained primarily flat over the last 12 months, with very little change.

- The number of monthly transactions over the last 12 months has also remained pretty flat, with very similar reported sales activity month over month.

- Average days on the market have increased, but only about 4% since last year.

Overall, these numbers are about what I would expect in an election year. Uncertainty tends to cause operators to hold off making any large capital investments, but we typically see a rebound the year after an election, no matter which way the vote turns out. If that holds true, I expect 2025 to be a solid year, especially if full Bonus Depreciation does end up getting re-instated. I think there is some pent-up demand from last year that should start to open up as things pick up in the new year.

I personally find that today’s buyers are becoming more and more selective in their aircraft requirements. The lower-time, good-pedigree aircraft remain hard to find, while the supply of older, higher-time “legacy” aircraft continues to increase. I expect we may soon get back to parting out more of these legacy aircraft, like we saw before the Covid market sent values skyrocketing.

I hope you find this information helpful. If you have any questions or would like some more detailed information on the current value of your aircraft, or any other aircraft you may be considering, please don’t hesitate to reach out.

Toby Smith – Vice President

JBA JETS, Inc.

918-630-4548

Toby.smith@jbajets.com

Toby Smith is Vice President of JBA JETS and has been helping customers buy and sell turbine aircraft for 17 years. He operates a satellite office located at the Atlantic Aviation FBO in Tulsa, Oklahoma.